How To Withdrawal Pf Amount For Repayment Of Housing Loan

For PF online transfer the form that needs to be filled up is Form 13. After attaining the age of 55 years.

Form31 Uan Epf Partial Withdraw English Form Make It Simple Employment

The amount cannot exceed 36 months basic salary and DA.

How to withdrawal pf amount for repayment of housing loan. The withdrawal amount sanctioned for this reason. The PF account holder hisher parents spouse or children can apply for withdrawal. Repay a housing loan for a house in the name of self.

How to withdraw pf for home loan repayment. Basic wage and dearness allowance. Employees Provident Fund or EPF is a popular savings scheme that has been introduced by the EPFO under the supervision of the Government of India.

Members share employers share and interest. PF withdrawal for repayment of housing loan. Withdrawal from the fund for repayment of loans in special cases.

90 of the amount can be withdrawn. You can withdraw up to 90 of your Provident Fund corpus to repay your home loan. Mode of remittance Account payee cheque mandatory for sitehouse flat purchase or construction through agency or repayment of housing loan Electronic mode.

Only the PF account holder and hisher spouse can apply for withdrawal. The withdrawal is done through the From 31 form for EPF partial withdrawal. Withdrawal under sl no e above.

If you are prepaying the debt loan you should have completed at least 10 years of service. Can i withdrawal my EPS amount if yes than whats is the procedure or how much it will take time. The members share towards the account must be Rs1000 inclusive of interest.

The money can be withdrawn for the purposes of constructing a flat or a house as well. Withdrawals from EPF Ac for Repayment of Home Loan. The EPF amount can be withdrawn both offline and.

A For refund of outstanding principal and interest of a loan for purposes under Para. PF account number. Money order only in the case of a withdrawal amount less than Rs2000.

Repayment of home loan. Make Your Dream Life A REALITY With 187 Branches 456 SME unit offices 399 ATMs 88 CDMs 300 agent banking outlets BRAC Bank offers you a wide range of financial solutions to meet your everyday needBe it home loan car loan or simply a quick loan simply drop an application and we shall do the rest while you enjoy life. An employee can prepay the home loan by withdrawing the PF amount.

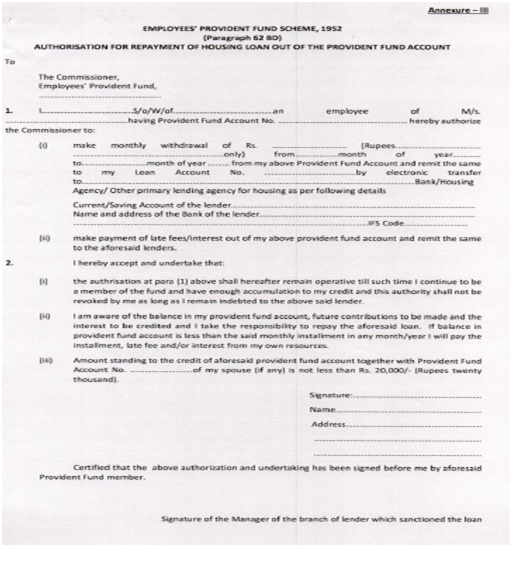

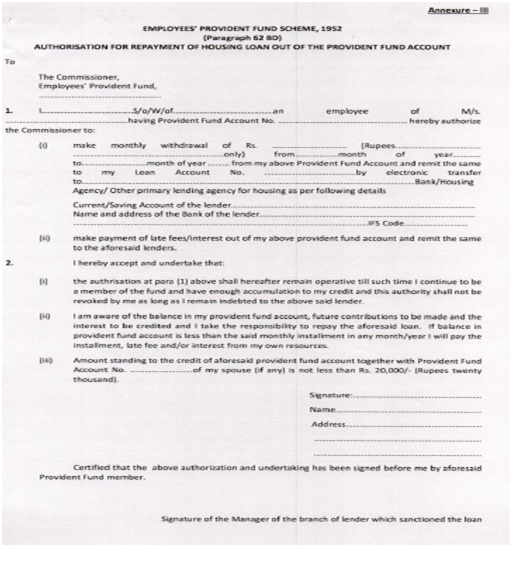

Follow these simple steps to utilize your EPF for repaying your home loan as per the updated EPF withdrawal rules-A PF member can apply for the loan through the housing society to the EPF Commissioner in the format prescribed in Annexure 1. The savings scheme is directed towards the salaried-class to facilitate their habit of saving money to build a substantial retirement corpus. For the withdrawal the employee should have reached at least 10 years of service.

Amount to be transferred to the Life Insurance Corporation of India for investment in Varishtha Pension Bima Yojana. You can do the withdrawal both offline and online. To avail this provision you need to submit Loan certificate statement to your employer along with From 31 form for EPF partial withdrawal.

The withdrawal amount that is admissible for this reason can be least of the below. The employee should be in continuous service for 3 years. Withdrawal permitted subject to furnishing of requisite documents as stated by the EPFO relating to the housing loan availed.

However PF withdrawal for the purposes of home loan repayment can be done only after the completion of 10 years membership. Under Section 80C of the Income Tax Act deduction of up to Rs15 lakh is allowed for the repayment of the principal amount of the home loan. You can also read about provident fund information online on the EPFO website.

EPF or PF Eligibility Benefits Process. 12 months basic wages and DA OR Employee Share with interest OR Cost Whichever is least 1 One 1ONE Member Declaration Form from Member II Para 68BB. My 52 year complete in a company after that i am withdrawal my PF but only EPF amount was received.

36 times of monthly salary or Total. Withdrawal for investment in Varishtha Pension Bima Yojana. Full postal address of the member.

Repayment of Home Loan. The Commissioner issues a certificate specifying the monthly contribution of the last 3 months. The accumulation in the members PF account or together with the spouse including the interest has to be more than Rs 20000.

The provident fund scheme allows you to avail of the withdrawal facility for repayment of the outstanding balance of a home loan taken by you or your spouse for any of the above purposes. Upto 90 of the EPF balance ie. On the other hand the forms associated with withdrawal or claims include Form 31 Part Withdrawal of PF funds Form 10C Pension Withdrawal and Form 19 Final PF Settlement.

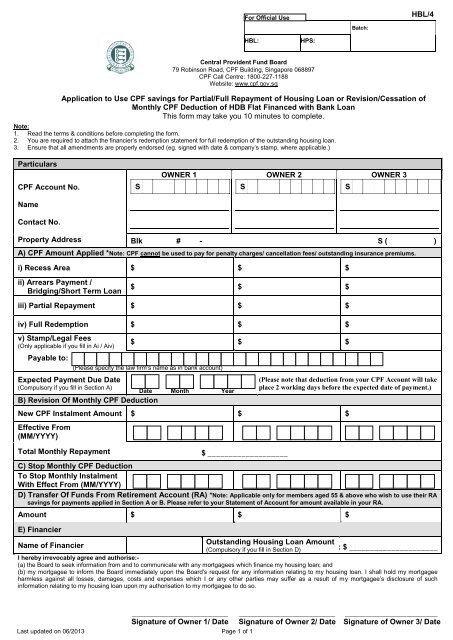

Kwsp Housing Loan Monthly Installment

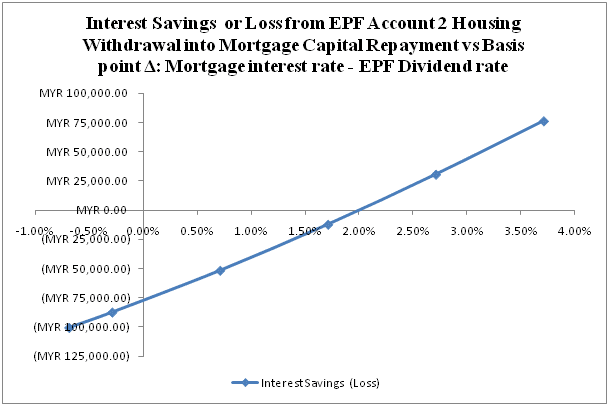

Epf Withdrawal For Housing Loans Reduction To Withdraw Or Not

Pf Partial Withdrawal Rules House Purchase Renovation Home Loan

Pf Withdrawal How To Withdraw Pf Amount Online Legal Services Withdrawn Online

Epf Partial Withdrawals Advances Options Guidelines 2020 21

You Can Use Your Epf Corpus To Pay Your Home Loan Emi Emi Calculator

Avail Home Loan Against Your Epf Amount Home Loans Loan Accounting

Epf Withdrawal For Buying House And Paying Emi New Epfo Rule

Epf Withdrawal For Housing Loans Reduction To Withdraw Or Not

Do I Have To Repay The Pf Advance Amount Can I Withdraw The Full Amount In A Form 31 Quora

Posting Komentar untuk "How To Withdrawal Pf Amount For Repayment Of Housing Loan"